Introduction

The pawnbroking industry has a long and rich history, particularly in provincial towns. Historically, pawnbrokers have played a significant role in providing financial services to local communities. Pawnbrokers, far from being a Victorian throwback, have seen a resurgence in popularity and usefulness, with revenues predicted to climb by 14% to £355 million [ref]. Part of what is widely known as ‘Fringe Banking’ [Ref] reports of the death of ‘Poor man’s bank’ have been vastly overstated [ref]. Not least because as of 2023 there is a lowering of affluence. This article aims to explore the current state of the pawnbroking industry in provincial towns, examining its history, consumer perspective, response to changing demands, and potential for growth. Additionally, we will address the challenges faced by pawnbrokers in these areas and focus on a specific example in our hometown – Cheltenham, Gloucestershire, UK. Let’s dive into the world of pawnbroking in medium sized UK towns.

Our qualifications

Earlier this year we created a new high growth website for Suttons & Robertsons. A very old, established brand who had an online presence that was under performing. Moreover like a lot of older industries they had little overview of traffic, analytics and who their audience was or potential audience could be. As part of our project we did a huge deep dive on this sector, so it seemed a shame to waste our knowledge. We generally have one client per sector, as we believe that our job is to try to boost our client above all competition. So for example we only have one car finance firm, one hotel chain etc.

A Look at the History and Current State of Pawnbroking in Provincial Towns

Before understanding the current state of pawnbroking in provincial towns, it is crucial to delve into its history. Pawnbroking dates back centuries, with pawnbrokers serving as important pillars of the local economies. These establishments have traditionally provided a valuable service, allowing individuals to secure short-term loans by collateralizing their personal assets.

The origins of pawnbroking can be traced back to ancient civilizations such as Mesopotamia and China. In Mesopotamia, pawnbrokers were known as “moneylenders” and played a vital role in facilitating trade and commerce. They would lend money against valuable items, such as jewellery, livestock, or even land, providing individuals with the much-needed financial support to pursue their endeavours. Similarly, in ancient China, pawnbroking was a well-established practice. Pawnshops, known as “yinpai,” were prevalent in both urban and rural areas. They served as a reliable source of credit for farmers, artisans, and merchants, who could borrow money against their possessions during times of financial hardship.

As time went on, pawnbroking spread across different regions of the world, adapting to the unique cultural and economic landscapes of each society. In medieval Europe, pawnbrokers were often associated with monasteries and religious institutions, as they provided loans to the poor and needy. These loans were typically given against items of value, such as clothing, tools, or household goods.

Fast-forward to the present day, and the pawnbroking industry in provincial towns has undergone significant changes. With the rise of online platforms and digital transactions, traditional pawnbrokers have had to adapt, or die, in a more technologically driven landscape. This shift has brought both challenges and opportunities, shaping the current state of the industry.

One of the challenges faced by pawnbrokers in provincial towns is the increased competition from online pawnbroking platforms, as we shall see later when we look at search results. These platforms offer individuals the convenience of securing loans from the comfort of their own homes, without the need to visit a physical pawnshop. This has led to a decline in foot traffic for traditional pawnbrokers, forcing them to find innovative ways to attract customers. This trend accelerated over lockdown, and has increasingly become the main way of accessing pawnbrokers by many people. This is partly because of the way that the shops are set up and because of the slightly shameful feelings that some would have around debt, money and poverty. Society has an old world view of Pawnbrokers which is a positive as well as a negative.

On the other hand, the digital revolution has also presented opportunities for pawnbrokers. Many traditional pawnshops have embraced technology by establishing their online presence. They now offer online valuation services, allowing individuals to get an estimate of the value of their items before visiting the physical store. This has streamlined the process and made it more convenient for customers, but traditional shops need to keep up with these online trends. Online traffic comes with analytics and data that can be much more useful than footfall traffic, in terms of business strategy and planning.

Furthermore, the current state of pawnbroking in provincial towns is also influenced by changing consumer attitudes towards borrowing and personal finance. In recent years, there has been a growing awareness about the importance of financial literacy and responsible borrowing. This has led to an increased demand for transparent and fair lending practices. Pawnbrokers have responded to this demand by implementing stricter regulations and ethical standards. They now ensure that customers are fully informed about the terms and conditions of their loans, including interest rates and repayment schedules. This transparency has helped build trust and credibility in the industry.

The history of pawnbroking in provincial towns is rich and diverse, spanning across centuries and continents. From its ancient origins to the challenges and opportunities of the digital age, pawnbroking has evolved to meet the changing needs of individuals and communities. As we move forward, it will be fascinating to see how this industry continues to adapt and thrive in the ever-evolving landscape of provincial towns.

Examining the Consumer Perspective on Pawnbroking Services

Understanding the perspective of consumers is crucial in assessing the state of the pawnbroking industry in provincial towns. For many individuals, pawnbroking serves as a lifeline during times of financial hardship. The accessibility and ease of securing a loan with collateral make pawnbroking services attractive to those in need of quick cash.

However, there are also misconceptions and stigmas associated with pawnbroking. Some potential patrons may have reservations about the perceived social implications of utilizing these services. Exploring the consumer perspective sheds light on the various factors influencing the industry’s state in provincial towns.

When examining the consumer perspective on pawnbroking services, it is important to consider the diverse range of individuals who utilize these services. From young adults struggling to pay off student loans to middle-aged individuals facing unexpected medical expenses, the reasons for seeking pawnbroking services are varied.

One common misconception surrounding pawnbroking is that it is primarily propagated by individuals who are financially irresponsible or unable to manage their money effectively. However, this assumption fails to acknowledge the reality that financial emergencies can happen to anyone, regardless of their financial literacy or planning. People can be rich in assets and material goods but their wealth is illiquid and tied up in investments and property.

Furthermore, pawnbroking services offer an alternative to traditional banking institutions, which may have stringent requirements and lengthy approval processes for loans. In many cases, individuals who turn to pawnbroking do so because they have been denied loans from banks or other financial institutions due to poor credit history or lack of collateral.

Another factor that influences the consumer perspective on pawnbroking services is the level of trust and transparency provided by pawnbrokers. Consumers want to ensure that their valuables are in safe hands and that they will be returned to them in the same condition once the loan is repaid. Establishing a sense of trust between the pawnbroker and the consumer is crucial for the industry’s success.

Moreover, the convenience and accessibility of pawnbroking services play a significant role in attracting consumers. Unlike traditional lenders, pawnbrokers are often located in easily accessible areas, making it convenient for individuals to bring in their valuables for assessment and secure a loan quickly. This accessibility factor is particularly important for those who may not have reliable transportation or live in remote areas with limited financial services.

It is also worth noting that the consumer perspective on pawnbroking services can be influenced by cultural and societal norms. In some communities, pawnbroking may be seen as a viable and accepted financial option, while in others, it may carry a negative stigma. Understanding these cultural nuances is essential for pawnbrokers to tailor their services and marketing strategies to specific communities.

In conclusion, examining the consumer perspective on pawnbroking services provides valuable insights into the industry’s state in provincial towns. By understanding the diverse range of individuals who utilize these services, debunking misconceptions, establishing trust, and considering cultural factors, pawnbrokers can better cater to the needs of their consumers and contribute to the growth and sustainability of the industry.

How Pawnbrokers are Responding to Changing Demands in Provincial Towns

In today’s rapidly evolving financial landscape, pawnbrokers in provincial towns are embracing innovation to meet changing demands. The introduction of online platforms has facilitated remote valuation and loan applications, enabling customers to engage in pawnbroking without physically visiting a brick-and-mortar store.

Furthermore, pawnbrokers have diversified their services to cater to a broader range of customer needs. Some establishments now offer additional financial services such as retail sales, luxury asset loans, and even virtual pawnbroking options. These adaptations reflect the efforts of pawnbrokers to remain relevant and competitive in the industry.

Pawnbroking – A Vital Financial Resource for Provincial Towns?

For many individuals in provincial towns, pawnbroking serves as a vital financial resource. With limited access to traditional banking services, pawnbrokers provide an alternative avenue for securing loans and navigating financial challenges. The convenience and flexibility offered by pawnbroking establishments make them an integral part of the local economy. Additionally, pawnbroking supports local entrepreneurship by providing opportunities for individuals to secure short-term funding for business ventures. In this way, pawnbroking plays a role in economic growth and development within provincial towns.

Addressing the Challenges Faced by Pawnbrokers in Provincial Towns

While the pawnbroking industry thrives in provincial towns, it is not without its challenges. Increasing regulations and compliance requirements place additional burdens on pawnbrokers, requiring them to invest in systems and processes to maintain transparency and adhere to legal obligations. Additionally, competition from digital platforms and the rise of alternative lending options present obstacles that must be navigated.

However, through strategic partnerships, embracing technology, and maintaining high standards of customer service, pawnbrokers continue to overcome these challenges and remain key players in provincial town economies.

Exploring the Potential for Growth in the Pawnbroking Industry in Provincial Towns

Despite the challenges faced by pawnbrokers, there is still potential for growth in the industry in provincial towns. As the financial landscape continues to evolve, so too does the demand for alternative lending options. Pawnbrokers can capitalize on this by further diversifying their services and leverageing technology to enhance customer experience.

Furthermore, educating the public about the benefits and value of pawnbroking can help dispel misconceptions and stigmas associated with the industry. By promoting transparency and building trust, pawnbrokers can attract a broader customer base and contribute to their respective towns’ economic growth.

An Example: Cheltenham UK and The Pawnbroking Industry

To gain deeper insight into the state of the pawnbroking industry, let’s focus on Cheltenham, UK, as an example. Cheltenham boasts a vibrant local economy with a substantial demand for pawnbroking services. The town has seen a rise in pawnbrokers, both traditional and online, catering to the needs of its residents.

Cheltenham’s unique blend of tourism, commerce, and residential communities provides an ideal setting for pawnbroking establishments to thrive. The industry has become an integral part of the town’s financial landscape, offering valuable services to both locals and visitors.

A Comparative List of Pawnbrokers in Cheltenham

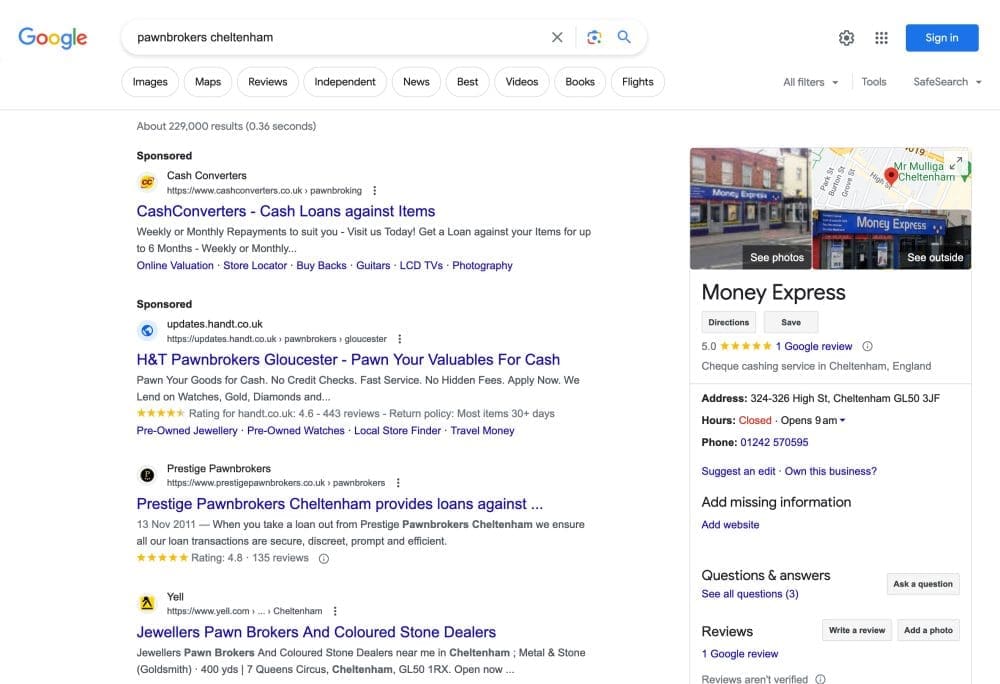

In Cheltenham, there is a range of pawnbrokers offering diverse services to cater to various customer needs. Here is a comparative list of pawnbrokers in Cheltenham, using Google as our guide (for if your listing is not on Google, how will folk find you).

Cheltenham Pawnbrokers: Providing traditional pawnbroking services with a focus on valuing and lending against fine jewellery. Based on Montpellier this is seen as old world, low volume but high value.

Cheltenham Cash Converters: Offering a wide array of pre-owned items for sale and providing pawnbroking services. This is seen as the bottom end of the market in terms of value, but high in volume.

Cheltenham CEX: CEX is an interesting case as it is a tech focused outfit which acts as a pawnbroker but does not ever say this word.

But the Cheltenham market is clearly a lucrative one. It has a population of high net worth individuals coming off the back of a service and technology based economy (as seen in our article on the amount of web agencies in Cheltenham). There is much old money, meaning of course old and inherited goods that will have a value at a pawnbroker. So in addition to the bricks and mortar shops a quick local search will reveal more nationwide competitors and sponsored listings.

Prestige Pawnbrokers: Are very clearly not Cheltenham based but say they are. This is a common them for all service businesses whereby national players try to muscle in on local online traffic.

H&T Pawnbrokers: Do not have a shop in Cheltenham though they are the country’s largest in therms of number of shops and the competitor to beat.

Mallard Jewellers is also in this camp. They have no stores in Gloucestershire but have an online presence when you search for or search in Cheltenham.

https://www.mallardjewellers.co.uk/our-stores

Another item that comes up on the listing and of importance to SEO and web ranking – and indeed in any local search is of course the Yellow Pages of this world. Google knows that other directories area useful way to show users a listing of businesses. The fact that so many listing sites come up is interesting. It tells us that there is an opportunity for optimisation and growth.

The Google search results for “pawnbrokers Cheltenham” highlight the diversity of services and approaches available in Cheltenham, providing customers with options to suit their specific requirements.

The pawnbroking industry in provincial towns continues to play a pivotal role in providing financial resources and support to local communities. Understanding the history, consumer perspective, response to changing demands, challenges, and potential for growth provides valuable insights into the industry’s current state. By embracing innovation and addressing regulatory requirements, pawnbrokers can adapt and thrive in an ever-changing financial landscape.

Footnotes

Forecast for the Pawnbroking industry in general

https://www.ibisworld.com/united-kingdom/market-research-reports/pawn-shops-industry/

revenue £355.0m up ’19-’241.4 %

‘Fringe’ banking (pawnbrokers, cheque cashing operators, and payday lenders)—an established, growing, and competitive provider of financial services to a wide swathe of society—has boomed in the last three decades. (Ref: https://onlinelibrary.wiley.com/doi/full/10.1111/ehr.13132)

‘Poor man’s bank’ on last legs in our more affluent society (ref: https://www.belfasttelegraph.co.uk/life/features/poor-mans-bank-on-last-legs-in-our-more-affluent-society/35074028.html)

History and Current State of Pawnbroking

Examining the Consumer Perspective

How Pawnbrokers are Responding to Changing Demands

Pawnbroking – A Vital Financial Resource?

Challenges Faced by Pawnbrokers

Exploring the Potential for Growth

An Example: Cheltenham UK and The Pawnbroking Industry

Download an Example report

We asked Obsolete.com to generate us a sample report on the state of the market of Pawnbrokers in provincial towns. And this 40 page deck is what they came up with. To see how it was done, get your own report. Remember this pdf is 100% generated.